Public Sector budgeting and planning is complex and challenging, especially personnel budgeting. Most Public Sector Agencies provide people driven services, typically their largest spend and the most challenging for budgeting and planning. This article will address three primary factors which make public sector planning and budgeting complex and challenging; they are (1)poor data, (2) disparate processes, and multiple applications often unable to share information between them causing (3) delays and inaccuracies in reporting. We will illustrate these complexities through a real-life example and outline a “best in class” approach that many large Public Sector Agencies are using to address these challenges to simplify their budgeting and planning process.

BUDGETING & PLANNING CHALLENGES:

I. POOR DATA:

Poor data quality is troublesome for a myriad of reasons, from analyst productivity loss to bad reporting and decision making, to potential negative impacts on revenue. Some of the causes for poor data quality are:

Multiple Disparate Databases

o The issue is these databases do not speak to each other, often creating a Tower of Bable effect which adds to complexity

Impaired Data Extraction protocols

o Like a Google search, one needs to know how to ask for the data and the proper business rules need to be in place to ensure you are getting what you requested

Mis-categorized/labeled data

o It’s like asking for a glass of Burgundy and getting a Chablis, the label must accurately reflect the data type requested

Static Data and Data Latency

o Data is often uploaded on a weekly/biweekly/ or monthly basis so it is never up to date in real time and revisions are often required

Poor or Absence of Data Governance

o Without a data governance program in place data will lack the integrity, structure and categorization necessary for easier and more accurate extraction

All Organizations struggle with data quality but those winning the battle are doing so with well-defined data governance programs in place. As nothing is full proof, many of these Organizations regularly audit their data for accuracy and /or have acquired data cleansing tools to help. In short, good quality data comes from a variety of methods and the discipline within Organizations that value it. Everyone has a stake in the value of data. Data quality isn’t only important for the practitioners behind the scenes but impacts C -Suite Executives, to lines of business, to analysts.

Cleaning up data starts with a commitment and often an executive mandate to achieve better quality. That is why many larger Organizations have created Chief Data Officer roles to spearhead these efforts.

Best in class Organizations have and are addressing their data challenges with structured data management and governance programs to achieve the result of completeness, correctness and clarity of their data, a vital element for any budgeting and planning process. Thus, allowing management to have at minimum the seeds for informed business decisions. Because the subject of data is so extensive it would take chapters to discuss, and thus for purposes of this article it is enough to alert the reader to its importance as a key foundational element in the budgeting and planning process.

II. IMPAIRED BUDGET FORMULATION (DISPARATE PROCESSES & MULTIPLE APPLICATIONS)

In the context of business management, the purpose of budgeting includes the following three aspects:

A forecast of income and expenditures (and thereby profitability)

A tool for decision making

A means to monitor business performance

Let’s look at each of these and why they pose such a challenge for Government Organizations. At first glance one would think this is no big deal, but as we unravel it, we will learn it is a great deal more challenging than one might believe.

In government, income is derived from taxes, fees, grants…, the aggregate of which must be delineated and dispersed to the Agencies to cover their expenses. Shortfalls are covered where deemed appropriate via the issuing of bonds and the like to get more cash to feed the budgets. This also means accounting for the allocated interest charges from the debt within the budgets.

Once the data starts getting pulled in to the budget process, the challenge comes with the utilization of poor data quality tied to process inefficiencies and exacerbated by inadequate technology.

Moreover, despite making significant investments in Enterprise Resource Planning (ERP) technology, which many Agencies may have thought would help address these challenges, they are discovering ERP Systems cannot answer the call. This is because ERP systems were not designed to manage the complexities of government budgets; they were designed to capture the transactions which they cannot synthesize in support of budgeting. Unfortunately, many Agencies strive to build around the limitation of their ERP with patchwork systems of point solutions comprised of financial forecasting software and spreadsheets. This patchwork approach only leads to further challenges where Agency financial teams must contend with bottlenecks, disparate data sources and siloed planning processes; all of which add up to more effort (labor intensive), increased risk of errors, and an impaired capacity to handle last minute changes absent massive effort. As such, work arounds with point solutions have the following deleterious effects on Agencies:

As you can see, not having the right tool for budgeting and forecasting the process and associated data are severely compromised. And because there is no singular tool for decision making there is no easy way to tie any of it to performance. In short, Agencies are hurting and “after all is said and done” defaulting back to the old process of incremental increases to the prior year’s budget. A process which hurts government and their Agencies because monies cannot be properly allocated to where they are needed the most, while others are fully consumed so they don’t lose it the following fiscal year. A highly inefficient and costly process which unfortunately is repeated year after year.

III. COMPRIMISED REPORTING

The result of poor data quality, incongruent processes, and the wrong budgeting/planning solution equate to subpar reporting. Some attributes of poor reporting include:

All of this impacts the ability of the Agencies to effectively manage their budgets and forecast for their needs in an efficient manner. Reporting is therefore comprised with little or no ability to make rapid adjustments in an ever-changing landscape. Simply put, compromised reporting leads to poor decision making.

I should be clear that these shortcomings are not the fault of Agency Finance folks or Department heads, but instead a clear lack of good data quality, ineffective processes, and deploying the wrong technology for the job. As discussed, ERPs were not created with budgeting and forecasting in mind, and the point solutions as work arounds have not only demonstrated their inability to solve the problem, but in many cases compound it, and increase the cost of doing business for the Agencies.

EXAMPLE – Case Study

Let’s see how these challenges play out in a simple yet complex Personnel Budgeting example. This example is detailed in the Comptroller’s Report for a major US city and spotlights their challenges for budgeting overtime.

“The City’s actual overtime expenditures increased over the last decade by more than $700 million (52.5 percent) from 1.46 billion in FY 2013 to $2.22 billion in FY 2022. The City keeps budgeting as though this increase never happened; the City overspent its overtime budget by 40 percent ($415 million) in FY 2013, growing to 93 percent in FY 2022 ($1.07 billion). Over the past decade, the City underbudgeted overtime expenses in the budget adopted each June, ostensibly with the goal of controlling overtime usage for the coming fiscal year. Underbudgeting, however, has not been a successful tool for controlling overtime cost. Uniformed police (approx. 65,000) overtime spending on average accounts for about 50 percent of the total overtime costs for uniformed employees and just about a third of the total annual overtime costs. Moreover, the City’s OMB (Office of Management & Budget) tells us that overtime costs also account for unplanned events like natural disasters (hurricanes), public unrest (civic protests and marches) …”

So why do substantial budgetary gaps continue to exist? In the example’s case the gaps will continue to exist because clearly under-budgeting is not the solution.

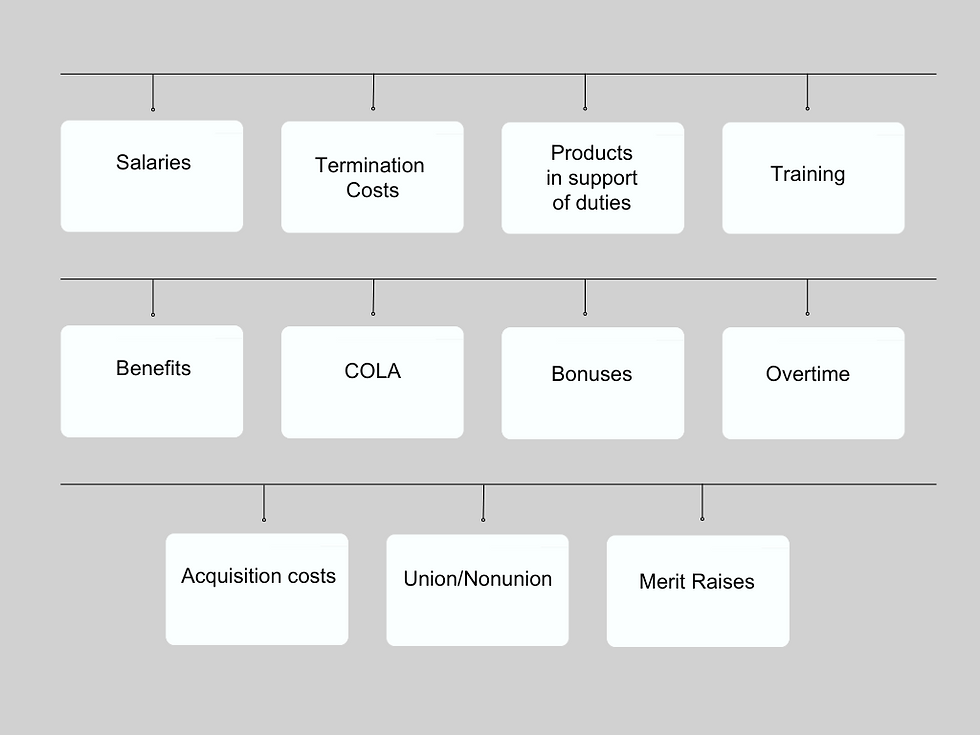

Furthermore, when you think for example how complex it is to manage so many variables for approximately 65,000 uniformed officers, and overtime just being one of many variables the answer seems obvious, it’s too difficult to manage with current processes and technology. The difference here is the complexity of budgeting for people in government can be overwhelming when dealing with many of the shortcomings we have discussed. Let’s take a closer look at some of these variables and the complications they can create when engaged on a large scale.

Variables:

When you think about some of these variables that make budgeting for personnel so complex it is because the problem is not one dimensional. For example (staggering vacation times- will there be enough coverage, who is using carry-overs -has it been accounted for, unexpected sick leave, are there any unforeseen issues that need addressing i.e. mass transit outage…) the problem is (X times Y times Z) divided by … equals a multi-dimensional exercise of significant complexity. One can see why the City in this example might choose to manage overtime in such a simplistic manner.

We can see why these budgets are so challenging despite the many talented men and women within City Agencies. The answer has nothing to do with the people preparing the budgets, but instead about the quality of the data, its extraction, multiple disparate processes, and the lack of an effective technology-based solution.

THE SOLUTION:

So how are best in class Government Organizations solving these Challenges?

There is, thankfully, an answer to this dilemma, and it starts with awareness.

Most Organizations know there is something broken in their budgeting and planning process but struggle to know where to start. Compound that with compromised data, driven through technology with significant limitations, leads to more confusion when all anyone wants is to do is their job.

Let’s look at this pictorial to better understand the dilemma.

Pictorial 1

As you can see all those lines depict the problem as Management has slowly added new applications to solve for whatever issue they were most troubled by. But, as discussed earlier, all these point’s solutions have only compounded the problem because these applications do not speak to each other, so they cannot easily share and reconcile data. Moreover, with more applications getting added, more needs to be maintained and data sources to be reconciled. Most Organizations just do the best they can and, in some cases, like the example of uniformed police they choose an over-simplistic alternative to deal with the issue. It’s like trying to work on a car engine with just a pair of plyers; you simply can’t address the crux of the problem.

Some Agencies may have conducted various forms of analysis either internally or more likely by engaging a consulting firm to address the problem. Unfortunately, when trying to solve for it they have often run into some additional complications, such as;

1. Lack of awareness - have they uncovered all of the practical solutions the marketplace has to offer (when buyers do not look holistically at how to solve the problem, they get distracted with point solutions)

2. Confusion - with so much out there claiming to do X, Y and Z they just don’t know how to reconcile all of it

3. The realization that they may have to customize some of their systems/applications often told to them by their ERP supplier/s. What has typically happened is their ERP supplier/s have suggested bolt on solutions (point solutions) which only address a portion of the problem. These systems were never meant to solve Finance’s challenges in a comprehensive manner (i.e., budgeting, planning, forecasting consolidation, reporting…) instead it only adds to the costs, inefficiencies, inaccuracies, and lack of transparency. It is like trying to modify a pickup truck to compete in formula 1. It will never be able to compete

4. Some mistakenly try and replace their ERP systems but that doesn’t help because, again, ERPs were not designed to solve the problem; it’s very costly and does not address the challenge

The answer is found in data, process, and technology. As posited earlier it is often not a people problem as they are being asked to do their jobs without the right tools, like the pickup truck example. That leaves data, process, and technology.

Processes can and should be corrected to deal with Agency strategies and demands. They need to be consistent across departments to avoid confusion and provide ease of rolling up budgets… to senior management. Most of this can be solved via workshops with key personnel. But there may yet remain a significant problem. What if the parties can solve the process issues, but the new technology cannot accommodate it, meaning they would have to customize the new or existing system/s (more cost, more complexity).

Best in class Organizations have and are addressing all the above issues by doing the following:

1. Conducting Current State, Future State and GAP analysis (know what you have and where to find it, what you need/want and what is missing to help get there)

2. Conducting workshops to determine consistent and best in class processes while looking at what new technology may offer out of the box which often provides 95% of what they need

3. Understand the role and value of their current ERP system/s and how to leverage it as well as other related systems

4. Address their data issues

5. Find a best-in-class configurable technology so as to avoid costly customizations to match the specific needs of their Organization

Below is an outline that describes how best in classes Government Organizations have dealt and are dealing with the process, technology, and data portions of the equation.

Best in class Agencies are deploying a solution that:

· Uses a unified software platform instead of multiple disparate applications or point solutions for planning and budgeting

· Feeds data from its core systems and ERPs into the unified planning system where the data is cleansed (via data cleansing algorithms) providing consistent, accurate and highly reliable data for planning

· Is agile and flexible, able to quickly conduct single and multiple scenario budget analysis and planning

· Uses standard and modern graphical reporting capabilities to provide management and leadership the right information at the right time in an easily consumed format for their needs

· Utilizes full automation and configurable business rules which promotes efficiencies, identifies and addresses exceptions, provides framework for standardized processing, reduces manual redundant efforts, and frees up resource time for more analysis and analytics

In the context of State and Local government a uniform software platform as described above is often the best solution to address not only personnel budgeting, but also the full spectrum of operational and capital budgeting.

Many large Public Sector agencies such as HUD, DHS, and many other Federal Agencies as well as large County Budget Offices have implemented this best-in-class solution to simplify their Planning and Budgeting Process.

==========================================================

About the Author

Mr. Marinelli has more than 25 years’ experience in both Industry and Consulting, where he

has worked for such leading companies as The Walt Disney Company, Verizon Communication, Deutsche Bank A.G., Siemens A.G., and Guardian Life Insurance Co in

various management roles at both the divisional and “C” levels. Mr. Marinelli specializes in

expense management, back-office re-restructuring and modernization, vendor management and out-sourcing services. He has worked on nearly all aspects of operational management and organizational re-structuring which included systems and process improvement. Mr. Marinelli has been a keynote speaker at trade and research events during his career and holds a JD from Seton Hall University School of Law.

Комментарии